Tech venture capitalists invest in startups and get to call them unicorns.

Startups like Juicero, famous for $700 a pop “smart” chopped fruit squeezers and being one of Silicon Valley’s dumbest moments, Wag! (oh? you have a dog walking app that sends updates on the frequency and consistency of pet number 2s? – here’s $300 million) and In-Real-Life or IRL, a chat app made for bot to bot communication.

The official definition of a unicorn is a startup with a $1 billion valuation while still a private company. There are more than 1,500 unicorns globally and a variety of investment products that track them.

Your humble correspondent felt that the mining industry deserves a similar category of company.

Mining has been starved of cash for years and telling unicorn chasers you are “literally sitting on a gold mine” appears to be a less compelling story to the minds of smart money than saying “we’re going to create an exchange where the shitcoin company A is mining can be swopped for the shitcoin company B to Z is mining” – and call it effective altruism.

This year copper grabbed the mainstream imagination and became the next big investment thing for a short but glorious moment.

It seemed apt that the first MINING.COM list of unicorns should be based on the bellwether metal.

It’s nothing like the Silicon Valley unicorn index because copper is not created out of thin air like Bored Ape Yacht Club NFTs, hot air like Nvidia’s current valuation or by charging cleaning fees like AirBnB.

The MINING.COM Unicorn Index does not compare mining apples with tech apples, or for that matter Juicero’s Sweet Roots (carrot, beet, orange, lemon and apple) with Spicy Greens (pineapple, romaine, celery, cucumber, spinach, parsley and jalapeño).

Neither is the MDC.CUI there to show that the money invested in startups like Yik Yak, a mobile app for college students to chat with others within a five mile radius that eliminates needless face to face campus interactions, is a waste of money compared to keeping the globe’s lights on.

Or to say that the $1.7 billion Quibi burned through to prove short form videos featuring expensive Hollywood actors had zero chance of going viral is less of a worthy endeavour than building a copper mine that transforms the fortunes of an entire country.

Or that the $189 million splashed on Quirky, a crowdsourcing platform for new product inventions like the Stem that sprays juice directly from citrus fruit, could have been better spent on the key ingredient for decarbonisation.

The MDC.CUI was created to say, and let’s stick to the theme, investing in copper makes the juice worth the squeeze even after the squeeze has been squoze.

Or put another way, investing in copper is what made every aspect of modern life possible (including robot pizza delivery by Zume worth $2.3 billion before going bust).

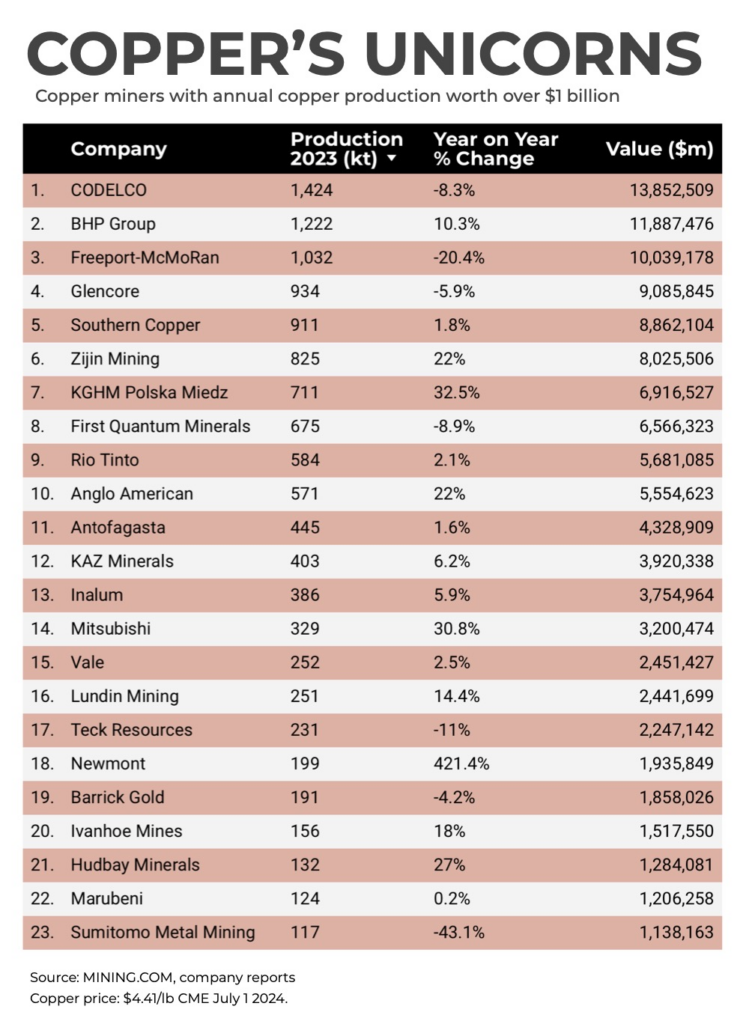

The MDC.CUI is a ranking of miners that produce more than $1 billion worth of copper each year.

At today’s price of $4.41 per pound, or $9,730 a tonne there are 23 and only 23 companies that make the list, producing 12.1 million tonnes annually, or more than half the world’s copper. When copper was hitting all time highs in May the ranking had all of 26 entrants.

In a world where a graphics card maker’s market cap is not more than twice that of the 100 hundred most valuable mining companies and the yearly money spent on crypto startups (yes, even after FTX, Celsius, BlockFi, the list is long) are not factors more than budgets for copper exploration, the MDC.CUI index would feature 100s of companies.

To be fair there is already a copper unicorn involved in mining. Chaired by a former chancellor of the exchequer UK-based Copper “was created to offer institutional investors a safe entrance into the world of digital assets.”

Oh, the irony.

Source: Mining.com