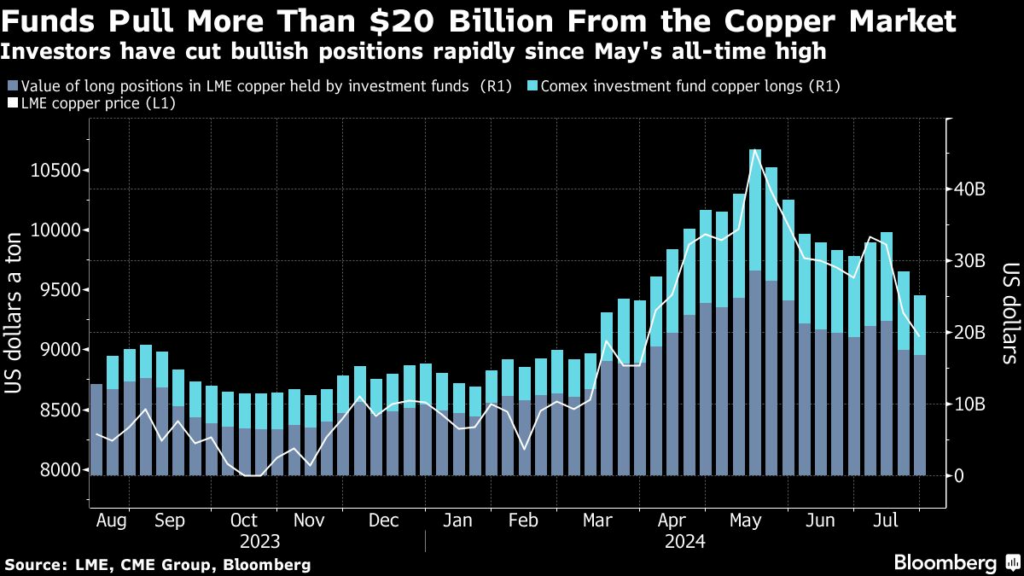

Money managers have closed out more than $20 billion in bullish copper bets since mid-May, with mounting worries about Chinese demand helping to spark a rapid exodus from one of the most important industrial commodities.

Copper spiked to a record above $11,100 a ton in May as investors embarked on an unprecedented buying spree, but prices have slumped by more than a fifth since then, with funds making a similarly seismic retreat.

The reversal comes as investors’ high-conviction bets on the bright long-term outlook for usage in data centers, renewables and electric vehicles has been tested by a historic bout of demand weakness in China.

Now, with prices hovering around $9,000, the key question among bulls and bears alike is whether the rush for the exit is over. Bullish positions on Comex and the London Metal Exchange are back near levels seen in March, but they remain elevated by historical standards.

“The market was clearly totally overbought in May, and probably momentum-based AI derivative trades were a part of the story,” said Daniel Major, a metals and mining analyst at UBS Group AG. “Have we seen the majority of the froth associated with that come out of the market? Yes, I think we probably have.”

From a fundamental standpoint, a looming crunch in supply is likely to give the remaining investors confidence to stick with their bets, he said. While demand is weak and the overall market is in surplus, there are growing expectations that smelters soon will be forced to cut output following a collapse in processing fees.

“That’s certainly sufficient to keep the investor positioning fairly sticky and, unless the macro deteriorates from here, I don’t envisage that we’ll get a massive liquidation of long positions,” Major said. “The setup remains constructive, and I think the market’s going to look through this weakness, consolidate in the near term and wait for those physical catalysts.”

Copper traded 1% lower at $8,932.50 a ton on the LME on Tuesday, heading for its lowest close since March.

Source: Mining.com